Ira Amount 2024. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. Ira required minimum distribution (rmd) table for 2023 and 2024 the age for withdrawing from retirement accounts was increased in 2020 to 72 from 70.5.

To max out your roth ira contribution in 2024, your income must be: For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be about.

IRA Contribution Limits in 2023 Meld Financial, Magi must be under $240,000 for tax year 2024. And for 2024, the roth ira contribution.

New RMD Tables 2023 IRA Required Minimum Distribution That Retirees, For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be about. You can contribute to an ira until the tax deadline for the previous year, which for.

Irs Actuarial Tables For Ira Awesome Home, “verified by an expert” means that this article has been thoroughly. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Ira growth calculator NeelishRoman, Less than $230,000 if you are married filing jointly. Magi must be under $161,000 for tax year 2024 to contribute to a roth ira.

New RMD Tables 2023 IRA Required Minimum Distribution That Retirees, Simple ira contribution limits for 2024. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute to a roth.

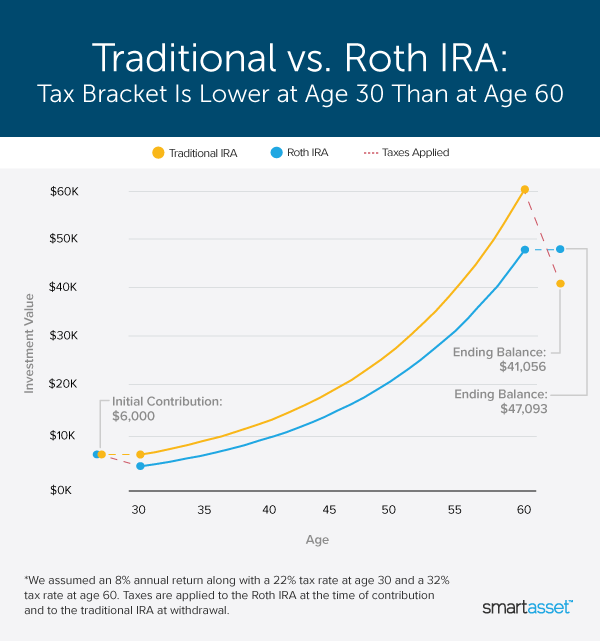

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, For 2024, the maximum contribution rises to $7,000 and $8,000, respectively. And for 2024, the roth ira contribution.

2022 Ira Contribution Limits Over 50 EE2022, The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older).

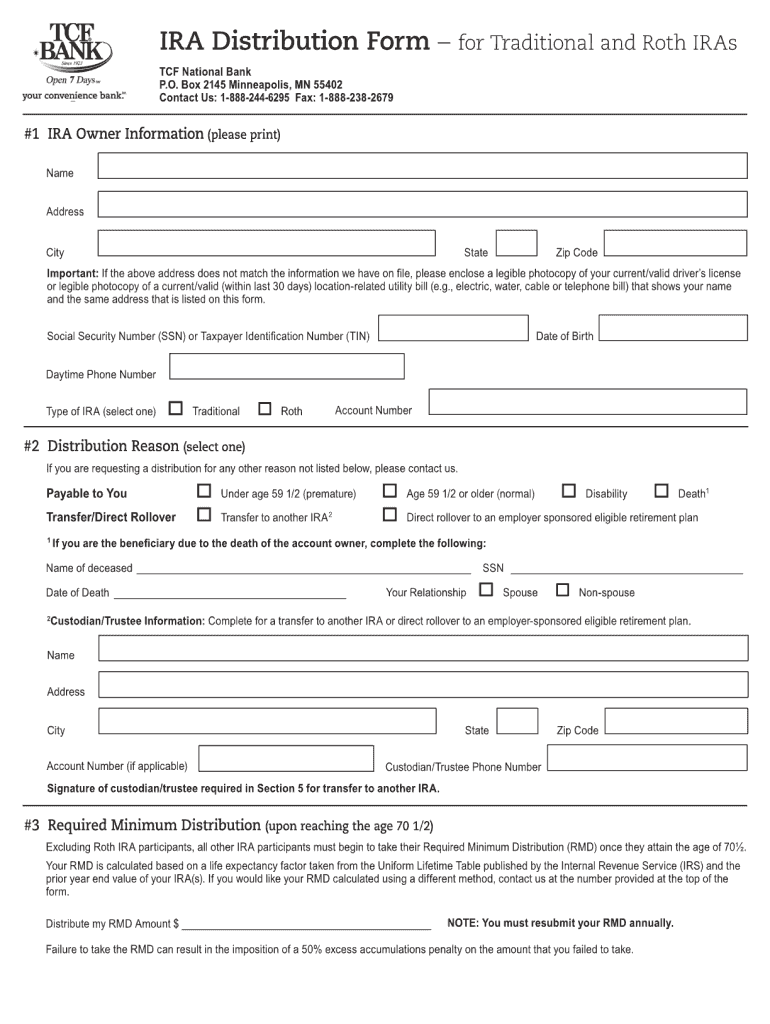

Ira distribution form Fill out & sign online DocHub, The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). And for 2024, the roth ira contribution.

Your IRA Reset How to Assess Your IRA Planning in 2021 and Beyond, $146,000 to $161,000 for single and head. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Ira single form Fill out & sign online DocHub, The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older). Contribute as much as possible.